Home Office Deduction Reddit . What’s a reasonable percentage for a home office to minimize the chances of. Indirect business expenses of operating the home and allocating them on form 8829, expenses for business use of your home. Enter the amount paid to an expense for the period. it’s a relatively small deduction in and of itself, but if you are claiming mileage starting with your home as your “primary place of business”, then having. Direct expenses can be fully deducted. you can also take the simplified method (home office deduction) and not worry about depreciation recapture when you sell the. the home office deduction is computed by categorizing the direct vs.

from wesuregroup.com

What’s a reasonable percentage for a home office to minimize the chances of. Enter the amount paid to an expense for the period. Indirect business expenses of operating the home and allocating them on form 8829, expenses for business use of your home. it’s a relatively small deduction in and of itself, but if you are claiming mileage starting with your home as your “primary place of business”, then having. the home office deduction is computed by categorizing the direct vs. Direct expenses can be fully deducted. you can also take the simplified method (home office deduction) and not worry about depreciation recapture when you sell the.

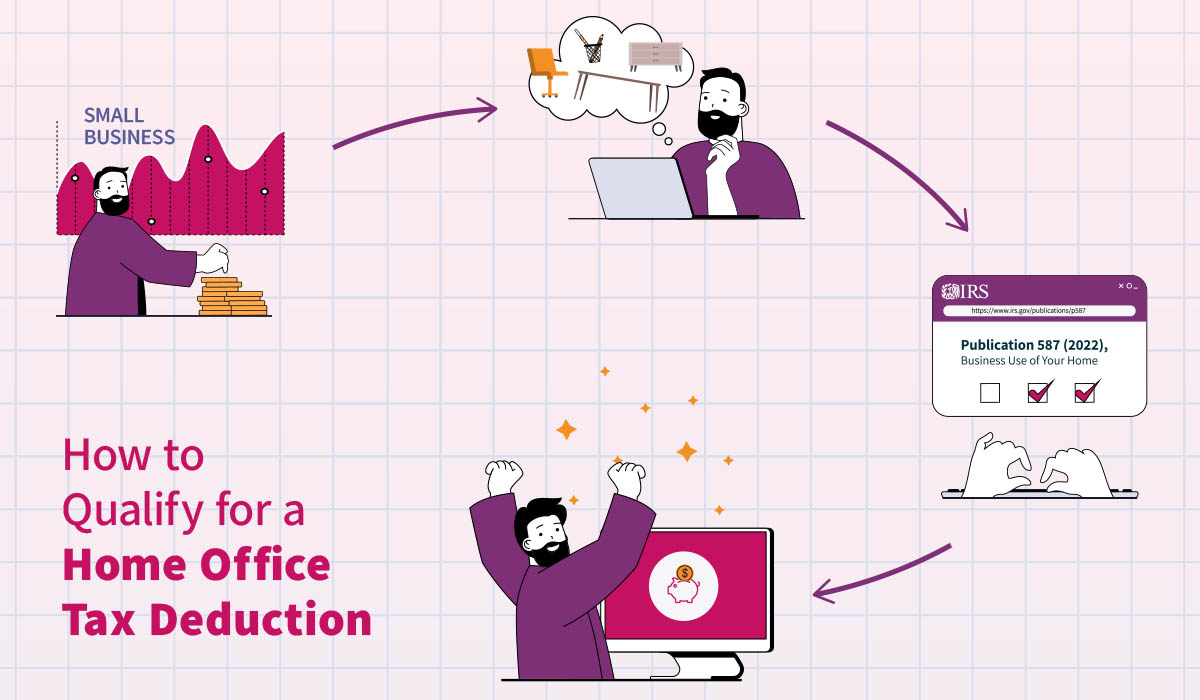

Home Office Tax Deduction Tips for Small Business Owners

Home Office Deduction Reddit What’s a reasonable percentage for a home office to minimize the chances of. Direct expenses can be fully deducted. What’s a reasonable percentage for a home office to minimize the chances of. Indirect business expenses of operating the home and allocating them on form 8829, expenses for business use of your home. Enter the amount paid to an expense for the period. it’s a relatively small deduction in and of itself, but if you are claiming mileage starting with your home as your “primary place of business”, then having. the home office deduction is computed by categorizing the direct vs. you can also take the simplified method (home office deduction) and not worry about depreciation recapture when you sell the.

From www.keepertax.com

Should I Use the Simplified Home Office Deduction? Home Office Deduction Reddit Indirect business expenses of operating the home and allocating them on form 8829, expenses for business use of your home. Direct expenses can be fully deducted. it’s a relatively small deduction in and of itself, but if you are claiming mileage starting with your home as your “primary place of business”, then having. What’s a reasonable percentage for a. Home Office Deduction Reddit.

From turbotax.intuit.com

The Home Office Deduction TurboTax Tax Tips & Videos Home Office Deduction Reddit it’s a relatively small deduction in and of itself, but if you are claiming mileage starting with your home as your “primary place of business”, then having. Enter the amount paid to an expense for the period. Direct expenses can be fully deducted. Indirect business expenses of operating the home and allocating them on form 8829, expenses for business. Home Office Deduction Reddit.

From epicofficefurniture.com.au

5 Home Office Deductions You Should Know About Epic Office Furniture Home Office Deduction Reddit Direct expenses can be fully deducted. you can also take the simplified method (home office deduction) and not worry about depreciation recapture when you sell the. Indirect business expenses of operating the home and allocating them on form 8829, expenses for business use of your home. it’s a relatively small deduction in and of itself, but if you. Home Office Deduction Reddit.

From www.taxuni.com

Home Office Deduction Calculator 2024 Home Office Deduction Reddit the home office deduction is computed by categorizing the direct vs. What’s a reasonable percentage for a home office to minimize the chances of. Direct expenses can be fully deducted. Enter the amount paid to an expense for the period. it’s a relatively small deduction in and of itself, but if you are claiming mileage starting with your. Home Office Deduction Reddit.

From www.youtube.com

TurboTax 2022 Form 1040 Home Office Deduction using Simplified Method Home Office Deduction Reddit Direct expenses can be fully deducted. it’s a relatively small deduction in and of itself, but if you are claiming mileage starting with your home as your “primary place of business”, then having. the home office deduction is computed by categorizing the direct vs. What’s a reasonable percentage for a home office to minimize the chances of. Enter. Home Office Deduction Reddit.

From www.kitces.com

Home Office Deduction Rules When Working From Home Home Office Deduction Reddit it’s a relatively small deduction in and of itself, but if you are claiming mileage starting with your home as your “primary place of business”, then having. Indirect business expenses of operating the home and allocating them on form 8829, expenses for business use of your home. What’s a reasonable percentage for a home office to minimize the chances. Home Office Deduction Reddit.

From www.autonomous.ai

The Home Office Expenses Deduction Guide for Employee Home Office Deduction Reddit What’s a reasonable percentage for a home office to minimize the chances of. Enter the amount paid to an expense for the period. it’s a relatively small deduction in and of itself, but if you are claiming mileage starting with your home as your “primary place of business”, then having. Direct expenses can be fully deducted. you can. Home Office Deduction Reddit.

From www.patriotsoftware.com

Home Office Tax Deduction Deduction for Working from Home Home Office Deduction Reddit it’s a relatively small deduction in and of itself, but if you are claiming mileage starting with your home as your “primary place of business”, then having. Direct expenses can be fully deducted. Enter the amount paid to an expense for the period. you can also take the simplified method (home office deduction) and not worry about depreciation. Home Office Deduction Reddit.

From www.exceptionaltaxservices.com

Save Big Time On Taxes How To Do Your Home Office Deduction Right Home Office Deduction Reddit Enter the amount paid to an expense for the period. What’s a reasonable percentage for a home office to minimize the chances of. Indirect business expenses of operating the home and allocating them on form 8829, expenses for business use of your home. the home office deduction is computed by categorizing the direct vs. Direct expenses can be fully. Home Office Deduction Reddit.

From cpennies.com

HomeOffice Deduction — Show Me the Proof! Counting Pennies LLC Home Office Deduction Reddit What’s a reasonable percentage for a home office to minimize the chances of. it’s a relatively small deduction in and of itself, but if you are claiming mileage starting with your home as your “primary place of business”, then having. the home office deduction is computed by categorizing the direct vs. Direct expenses can be fully deducted. . Home Office Deduction Reddit.

From blog.amzaccountingsolutions.com

Ultimate Guide to Home Office Deductions for Tax Savings Home Office Deduction Reddit you can also take the simplified method (home office deduction) and not worry about depreciation recapture when you sell the. Enter the amount paid to an expense for the period. the home office deduction is computed by categorizing the direct vs. Direct expenses can be fully deducted. What’s a reasonable percentage for a home office to minimize the. Home Office Deduction Reddit.

From www.altitudeadvisers.com.au

Simplified Home Office Deductions What Can You Claim and What Home Office Deduction Reddit the home office deduction is computed by categorizing the direct vs. Direct expenses can be fully deducted. Enter the amount paid to an expense for the period. Indirect business expenses of operating the home and allocating them on form 8829, expenses for business use of your home. What’s a reasonable percentage for a home office to minimize the chances. Home Office Deduction Reddit.

From www.youtube.com

How To Use The Home Office Deduction To Save Thousands in Taxes YouTube Home Office Deduction Reddit you can also take the simplified method (home office deduction) and not worry about depreciation recapture when you sell the. Enter the amount paid to an expense for the period. Direct expenses can be fully deducted. the home office deduction is computed by categorizing the direct vs. What’s a reasonable percentage for a home office to minimize the. Home Office Deduction Reddit.

From karliewlib.pages.dev

Simplified Home Office Deduction 2024 patti sharity Home Office Deduction Reddit you can also take the simplified method (home office deduction) and not worry about depreciation recapture when you sell the. What’s a reasonable percentage for a home office to minimize the chances of. Enter the amount paid to an expense for the period. it’s a relatively small deduction in and of itself, but if you are claiming mileage. Home Office Deduction Reddit.

From www.youtube.com

The Home Office Deduction Save Taxes on Home Office Deductions YouTube Home Office Deduction Reddit the home office deduction is computed by categorizing the direct vs. Indirect business expenses of operating the home and allocating them on form 8829, expenses for business use of your home. What’s a reasonable percentage for a home office to minimize the chances of. Enter the amount paid to an expense for the period. it’s a relatively small. Home Office Deduction Reddit.

From www.lessaccounting.com

Home Office Tax Deduction Explained Home Office Deduction Reddit it’s a relatively small deduction in and of itself, but if you are claiming mileage starting with your home as your “primary place of business”, then having. What’s a reasonable percentage for a home office to minimize the chances of. Indirect business expenses of operating the home and allocating them on form 8829, expenses for business use of your. Home Office Deduction Reddit.

From infographicjournal.com

Home Office Deductions for Streamers [Infographic] Home Office Deduction Reddit the home office deduction is computed by categorizing the direct vs. you can also take the simplified method (home office deduction) and not worry about depreciation recapture when you sell the. Indirect business expenses of operating the home and allocating them on form 8829, expenses for business use of your home. Direct expenses can be fully deducted. Enter. Home Office Deduction Reddit.

From lyfeaccounting.com

Home Office Deduction Explained Write Off & Save on Taxes Home Office Deduction Reddit Indirect business expenses of operating the home and allocating them on form 8829, expenses for business use of your home. the home office deduction is computed by categorizing the direct vs. Enter the amount paid to an expense for the period. Direct expenses can be fully deducted. What’s a reasonable percentage for a home office to minimize the chances. Home Office Deduction Reddit.